Clean, Intuitive Interface

A professional desktop application designed for ease of use

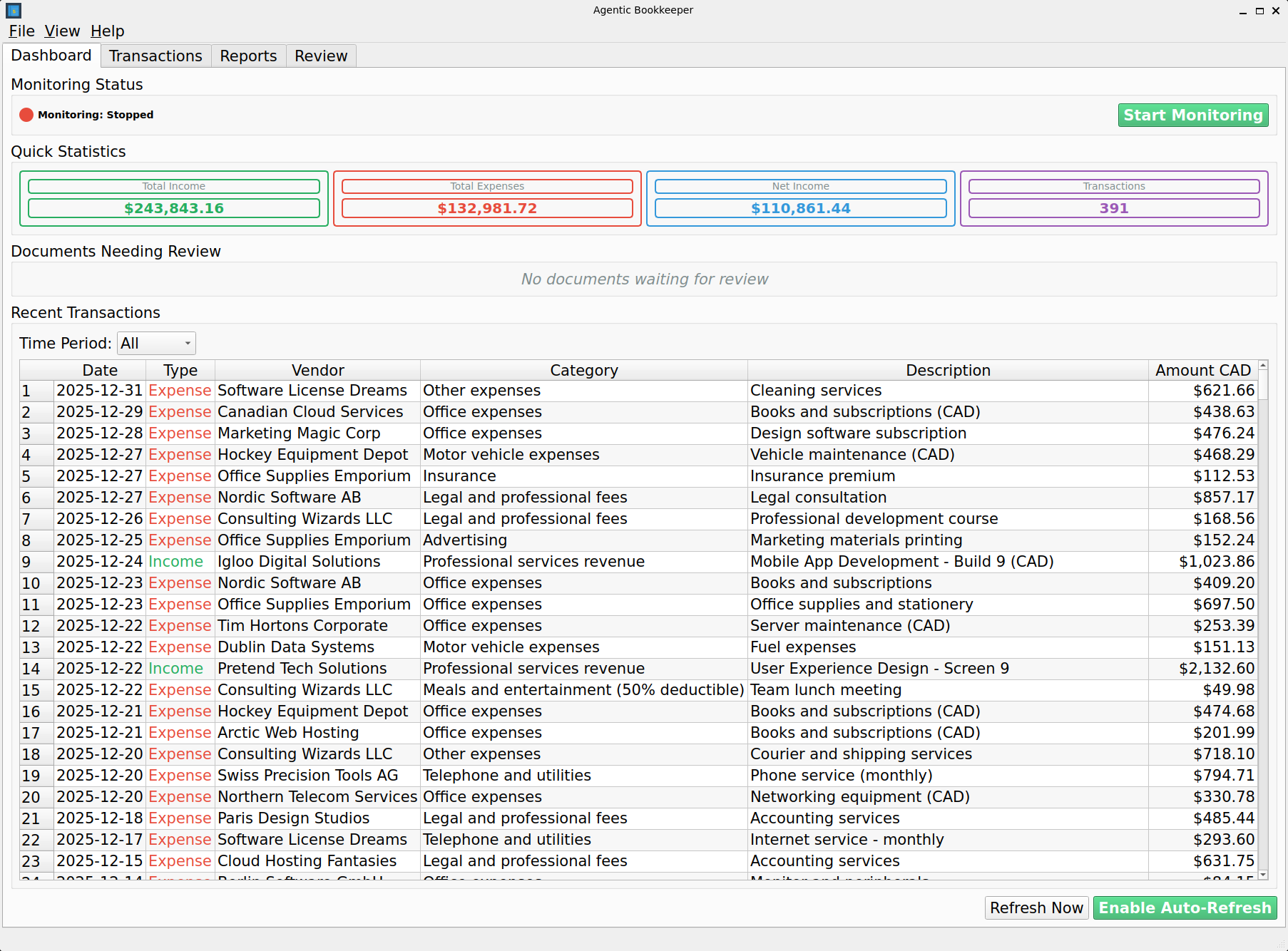

Dashboard

Real-time overview with income, expenses, net position, and document processing status

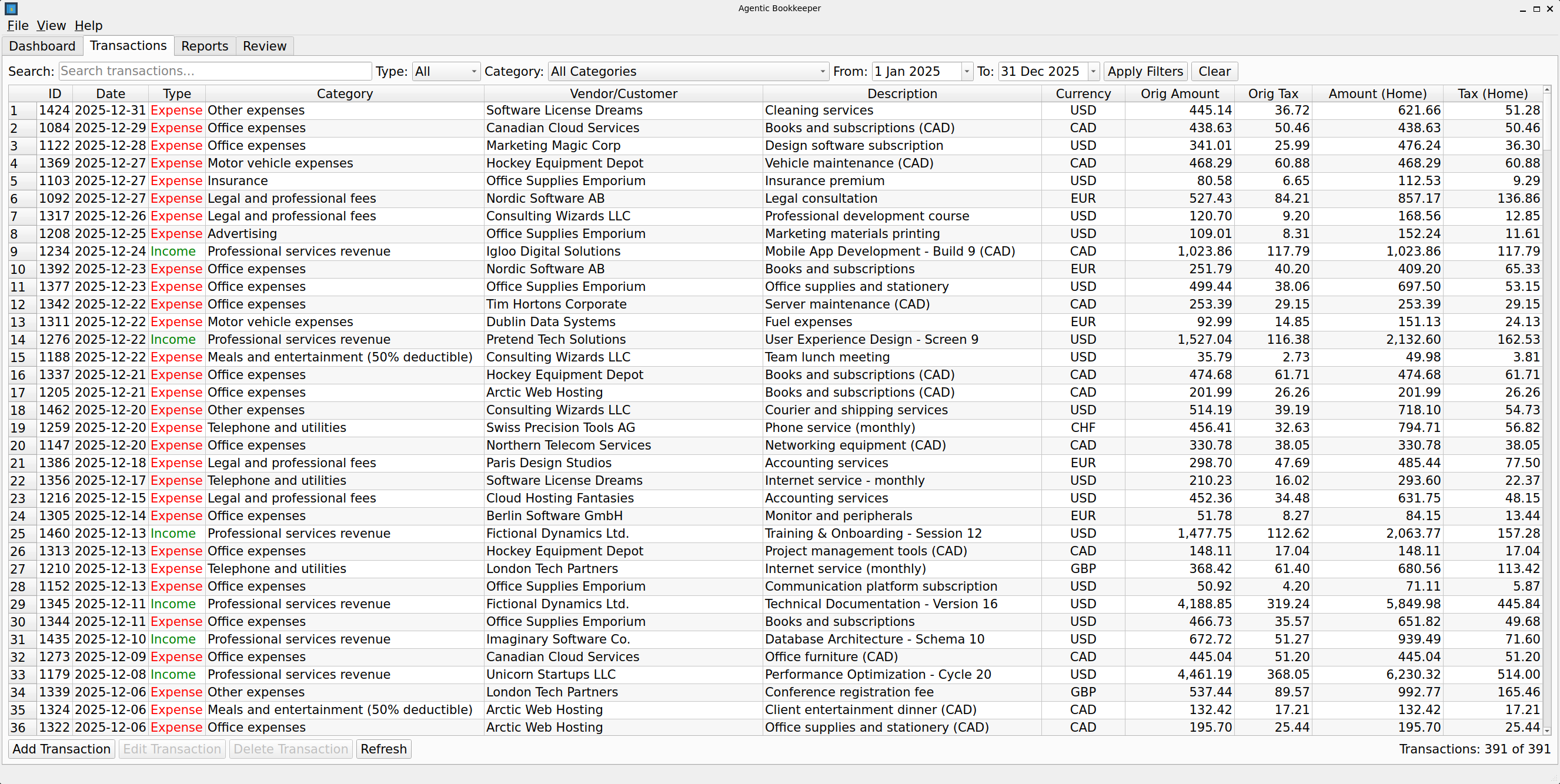

Transaction Management

Advanced filtering, multi-currency display, and easy transaction editing

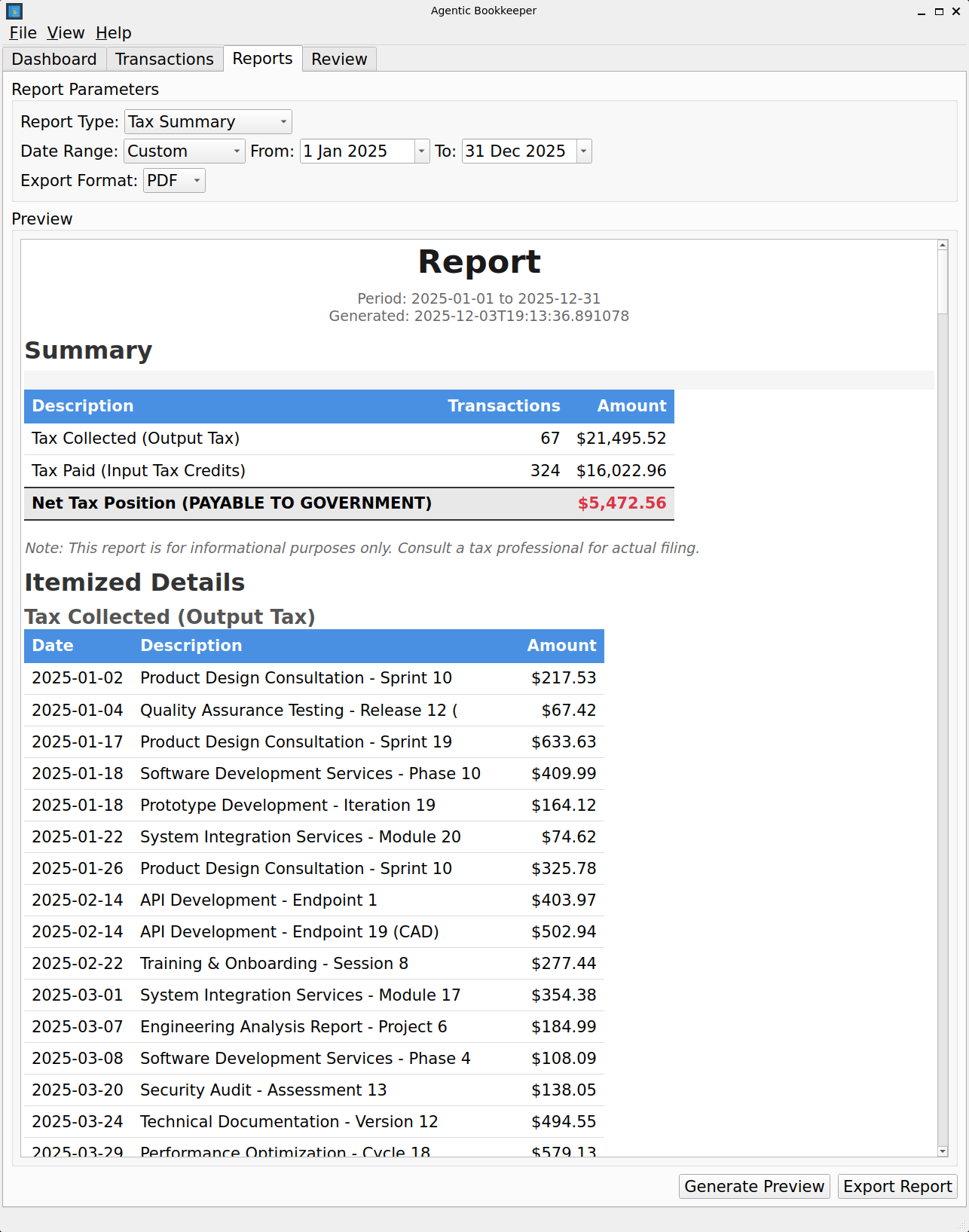

Tax Summary Report

Complete GST/HST tracking with output tax, input credits, and net position

Progress Tracker

Real-time visual feedback while processing batches of documents

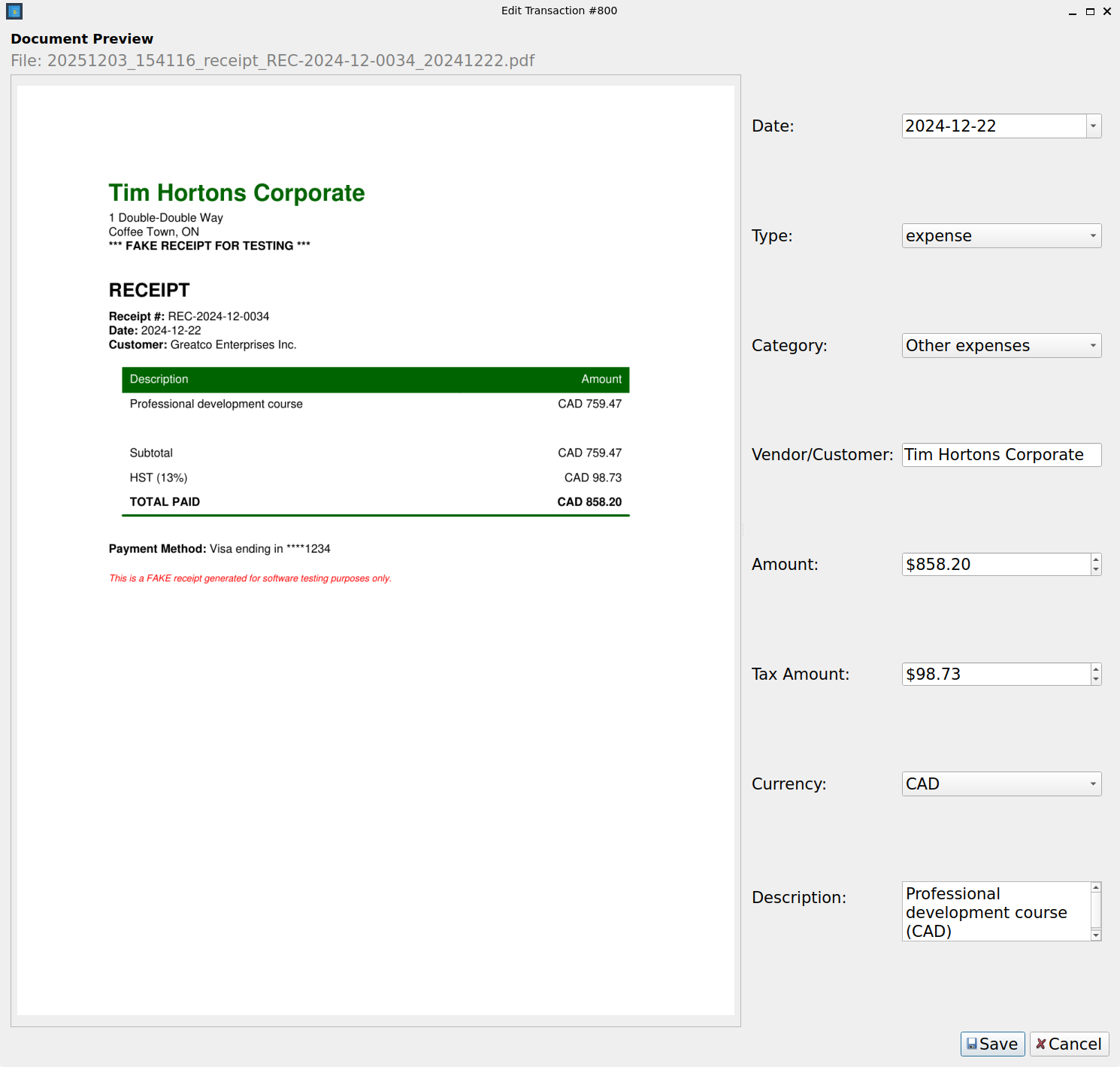

Edit Transaction

Easy editing with category selection and tax adjustments